General Ledger Utility Functions

|

G/L Interface Maintenance |

Last Revised: 01/10/14 |

Dynamo is an integrated application. This means that all transactions flow through to the Dynamo General Ledger without the need to make manual journal entries. This application is used to maintain many of the General Ledger account numbers that are used when posting to the General Ledger.

Some G/L accounts can vary by G/L location, e.g., branch, warehouse, etc. Other accounts do not vary by location and only have one account that applies to then entire company.

This application has four major categories:

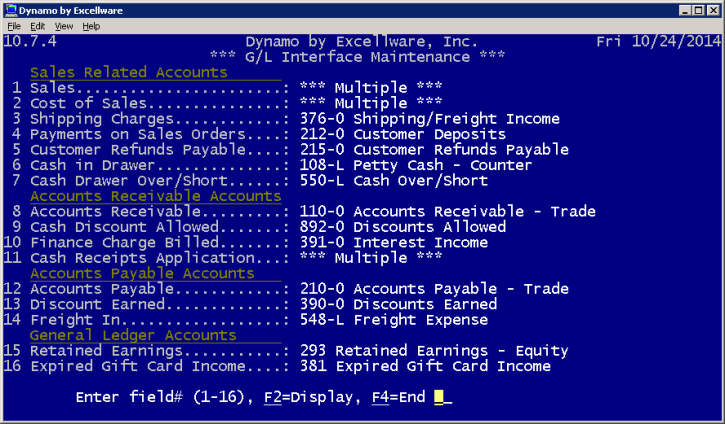

- Sales, Accounts Receivable (A/R), Accounts Payable (A/P), and General Ledger (G/L) accounts

- Inventory Accounts

- Rental Accounts

- Special Purpose Accounts

| Sales Related Accounts | |

|---|---|

| Sales | Try to specify as few sales G/L accounts as possible. Many companies only have one. If you have more than one, then specify the G/L Account to use by default, with the [ALL] Description, and then enter any exceptions by product category or product class. These accounts should be in the Revenue Account Group. The Sales account typically varies by the Dynamo Branch code. |

| Cost of Sales |

|

| Shipping Charges |

|

| Payments on Sales Orders |

|

| Customer Refunds Payable | For retail stores, customers may return items that cost more than the amount available in the cash drawer. The balance in this account represents funds that must be paid to customers who have requested refund payments. |

| Cash in Drawer | The balance in this account represents the amount of money available in a location's cash drawer at the end of each night. The amount may vary from location to location. |

| Cash Drawer Over/Short | During Cash Drawer Balancing, when making a bank deposit, any variation in cash between what is counted in the drawer and what Dynamo shows should be in the Cash Drawer is posted to this account. These accounts should be in the Expense or Other income/expense Account Groups. |

| Accounts Receivable Accounts | |

|---|---|

| Accounts Receivable |

|

| Cash Discount Allowed |

|

| Finance Charge Billed |

|

| Cash Receipts Application |

|

| Accounts Payable Accounts | |

|---|---|

| Accounts Payable |

|

| Discount Earned |

|

| Freight In |

|

| General Ledger Accounts | |

| Retained Earnings |

|

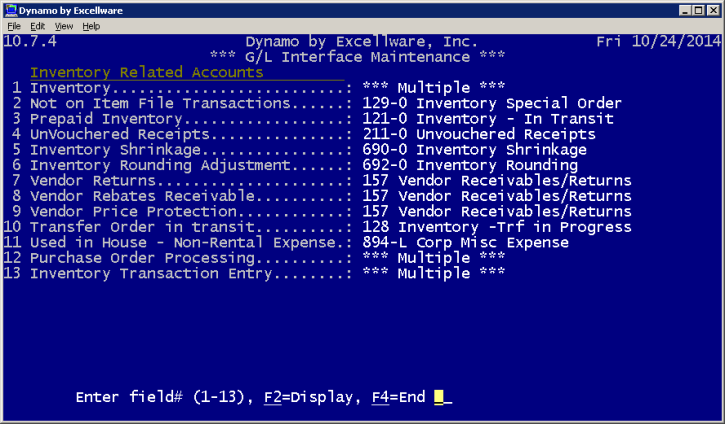

| Inventory Related Accounts | |

|---|---|

| Inventory |

|

| Not on Item File Transactions |

|

| Prepaid Inventory |

|

| UnVouchered Receipts |

|

| Inventory Shrinkage |

|

| Inventory Rounding Adjustment |

|

| Vendor Returns |

|

| Vendor Rebates Receivable | This account represents the vendor rebates receivable balance expected from occasions in which a vendor gives rebates for a customer's adherence to certain purchase requirements/levels. Typically, these estimates are measured in percents. If the operator does not want to estimate these numbers, Vendor Returns Receivables can be used instead. |

| Vendor Price Protection | This account contains the amount for when a customer requests a refund on an item after its price has been lowered. The refund amount is calculated based on the Quantity on Hand that remains after selling items at the previous price. |

| Transfer Order in transit |

|

| Used in House -Non-Rental Expense | Specify the general ledger account used if non-rental inventory is used in house. This account will be debited. |

| Purchase Order Processing |

|

| Inventory Transaction Entry |

|

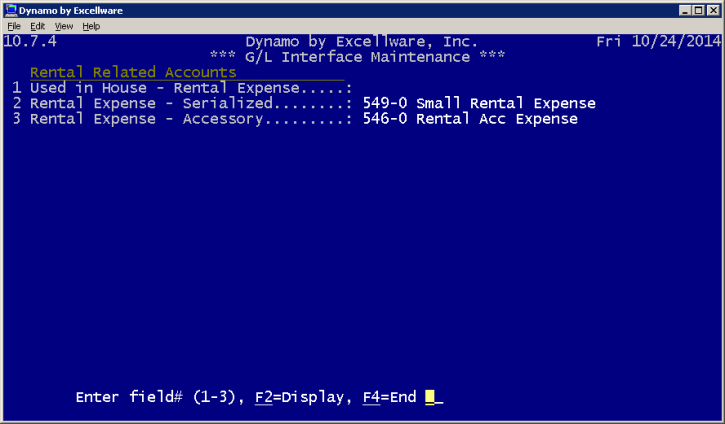

| Rental Related Accounts | |

|---|---|

| Used in House - Rental Expense | When a product is received into a Dynamo warehouse coded as 'Rental' type and used within the company, this account is debited. This account is only necessary if a company makes a distinction between rental and sales items when they are used in house. |

| Rental Expense -Serialized |

|

| Rental Expense - Accessory |

|

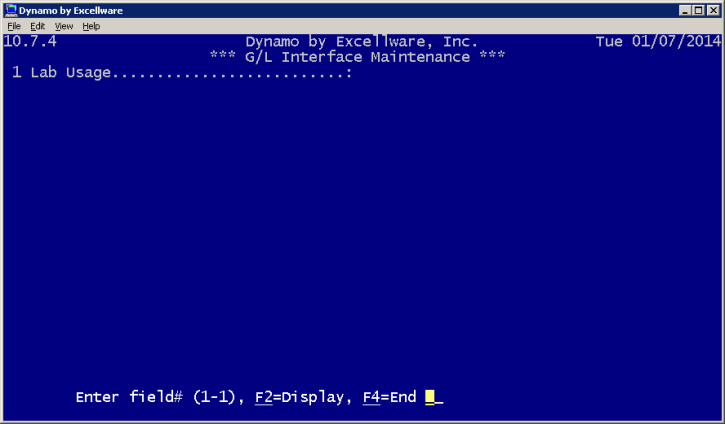

| Lab Usage | If a company uses inventory in a lab, the funds can be posted to the general ledger account specified here. These items are not subject to use tax. |