General ledger Utility functions

|

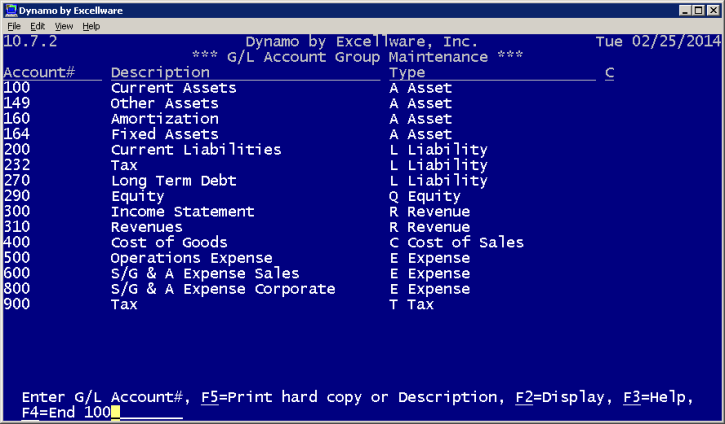

G/L Account Group Maintenance |

Last Revised: 02/25/14 |

G/L Account Group Maintenance is for the purpose of grouping similar type of accounts on your General Ledger financial reports.

Accounts generally fall into one of the following types:

|

Account Types |

||

|---|---|---|

| A | Assets | Resources owned by the company including Cash, Accounts Receivable (what customers owe you), Inventory (goods held for sale) |

| L | Liabilities | Your obligation to pay others including Accounts Payable (amounts owed to vendors), Notes Payables (amounts owed to banks), and Mortgage Payable (amount owed for purchased property) |

| Q | Equity | Value of a property or interest in excess of claims against it including Retained Earnings |

| R | Revenue | Includes Income from the sales of goods or services |

| C | Cost of Sales | Cash or cash equivalent sacrificed for goods or services that are expected to provide benefits to your company |

| E | Expense | The cost incurred in the normal course of business to generate revenues including employee salaries, utilities, etc. |

| T | Tax | Charges imposed by governmental authorities for public purposes |

| O | Other Income & Expenses | Other sources of income (and expenses) such as Interest Earned |

Enter the account number and description of the first account in each "group" of accounts and identify its type. For example:

| Account Number | Description | Type |

|---|---|---|

| 100 | Current Assets | A Asset |

| 149 | Other Assets | A Asset |

| 160 | Amortization | A Asset |

| 164 | Fixed Assets | A Asset |

| 200 | Current Liabilities | L Liability |

| 232 | Tax | L Liability |

Using the above example, all accounts between 100 and 164 would be grouped together as Assets on a financial report, all accounts between account 200 and 270 would be grouped together, and so on. General Ledger financial reports would print a subtotal for each of these groups.

The Chart of Accounts Listing (on the G/L menu) will include the group description.