Accounts Payable

|

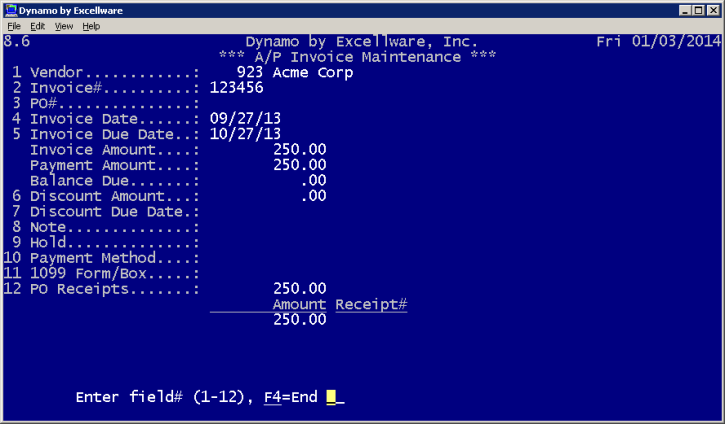

A/P Invoice Maintenance |

Last Revised: 06/18/14 |

A/P Invoice Maintenance is used to adjust specific invoice entries after the invoice has been updated.

| A/P Invoice Maintenance Primary View | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Vendor | Select the vendor whose invoice is to be maintained. | ||||||||

| Invoice# | Select the invoice number to be maintained. | ||||||||

| PO# | The purchase order number should automatically appear when the invoice number is entered, but it can also be changed here. | ||||||||

| Invoice Date | Maintain the date the invoice was generated. | ||||||||

| Invoice Due Date | Maintain the date the invoice is due. | ||||||||

| Invoice Amount | This field will display the amount shown on the invoice. To maintain an invoice amount, use A/P Invoice Data Entry. | ||||||||

| Payment Amount | This field displays how much has been paid on this invoice. | ||||||||

| Balance Due | Indicates how much is still owed on the current invoice. | ||||||||

| Discount Amount | Maintain the amount of any discounts on this invoice (if applicable). | ||||||||

| Discount Due Date | Maintain the due date of the discount (if applicable). | ||||||||

| Note | Maintain the note that will be included on the invoice (optional). | ||||||||

| Hold | Indicate whether or not this invoice is on hold. If it is on hold, then it cannot be paid. Normally, when necessary, an invoice will be put on hold upon receipt rather than during invoice maintenance, so typically this is used to remove a hold on an invoice. | ||||||||

| Payment Method |

Select one of the following:

|

||||||||

| 1099 Form/Box |

Select one of the following for the form (where applicable):

Select which box information will be printed in. For example:

Dividend

Interest

|

||||||||

| PO Receipts | Indicate any PO Receipts numbers that are associated with the current invoice. | ||||||||

Note: The Discount field is the only "amount" field that can be changed through Invoice Maintenance.

To make changes to the invoice amount or G/L account distribution, go to Invoice Data Entry, since this will create an adjustment to the General Ledger. (Refer to Invoice Data Entry documentation on "Correcting Invoice Entries that Have Been Updated".)

Once a vendor has been entered, a prompt will give you the option to enter a specific invoice number OR to display a list of invoices by using the F2 key.

Upon selecting a specific invoice, you will be prompted to select the field needing adjustment. For example, to release an invoice for payment that was previously put on Hold, enter the Hold field number and delete the previous entry.

Note: If an invoice has already been selected for payment and then a change is made through Invoice Maintenance (for example, a discount was entered), go to Payment Selection, clear the existing payment batch containing this invoice, and run it again.

The invoices will be rescanned and the adjustment will be recognized by the system.